Direct Answer Section (Above the Fold)

Foreign companies can enter India through acquisitions, joint ventures, or greenfield investments. The most suitable entry strategy depends on the level of control required, sector-specific FDI regulations, speed to market, capital commitment, and long-term exit objectives. Acquisition targets India offer faster market access, joint ventures reduce execution risk, while greenfield investments provide full control but require longer setup timelines.

Key Entry Options Explained

Acquisition

An acquisition involves purchasing a majority or minority stake in an existing Indian company. This approach enables immediate access to customers, licenses, employees, and operating infrastructure. However, outcomes depend less on valuation and more on promoter alignment, governance rights, and post-acquisition integration.

Joint Venture (JV)

A joint venture involves partnering with an Indian company to enter the market together. JVs can reduce initial capital exposure and help navigate local regulations and relationships. Common challenges include decision-making deadlocks, unclear exit mechanisms, and differences in growth and control expectations.

Greenfield Investment

A greenfield investment involves setting up a wholly owned subsidiary in India. This route offers maximum operational and governance control but typically requires more time to obtain approvals, establish teams, and build market presence from the ground up.

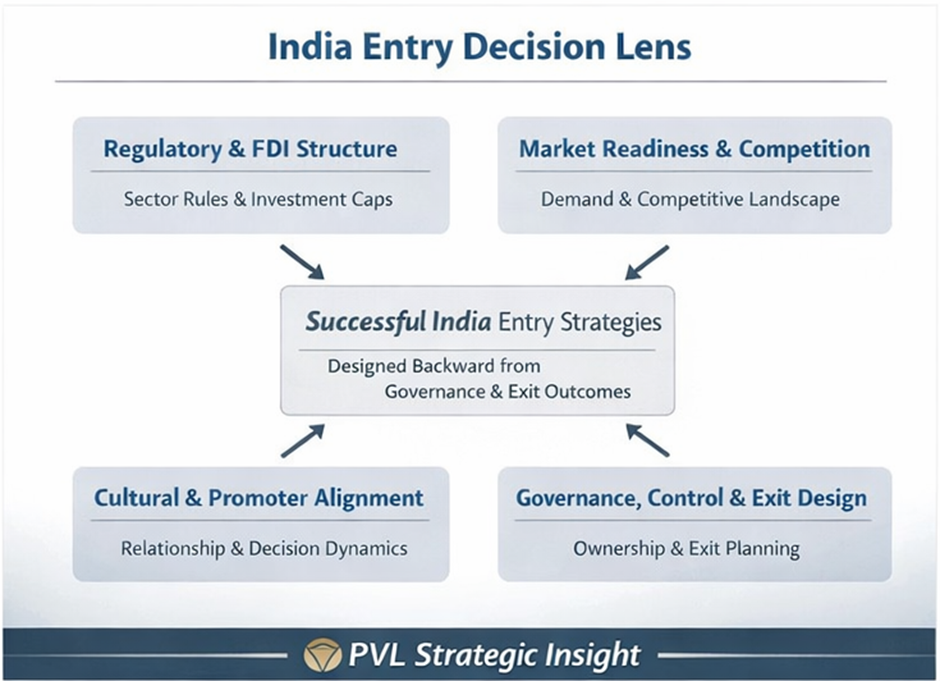

Strategic Considerations Before Entry

Before selecting an entry strategy, foreign companies should assess several practical factors:

- Regulatory risk: Sector caps, approval routes, and downstream investment rules can materially affect deal structure and timelines.

- Market readiness: Demand dynamics, pricing sensitivity, and competitive intensity vary significantly across sectors and regions.

- Cultural alignment: Many Indian businesses are promoter-led, and decision-making often reflects relationship dynamics in addition to contractual terms.

- Capital deployment: Phased capital deployment can reduce risk compared to full upfront investment.

Effective entry strategies are designed around how control, accountability, and exits will work in practice—not only on paper.

Common Mistakes and Risk Areas

Foreign companies often face challenges due to avoidable missteps, including:

- Choosing an entry structure based on regulatory simplicity rather than long-term control.

- Over-reliance on local partners without clearly defined governance and exit rights.

- Underestimating post-acquisition integration issues such as talent retention and reporting discipline.

- Ignoring exit planning at the entry stage, leading to disputes or stalled growth later.

Identifying these risks early significantly improves long-term outcomes.

Expert Insight

In practice, India entry strategies fail less because of regulatory barriers and more because of misaligned expectations. Foreign investors often focus on ownership percentages, while Indian promoters focus on control, continuity, and influence. Successful entry strategies are designed backward—from governance clarity and exit outcomes—rather than forward from deal structure or approval timelines.

FAQs

What is foreign direct investment (FDI) in India?

Foreign direct investment refers to investment by a non-resident entity into an Indian business through equity ownership or capital contribution, subject to sector-specific regulations and India’s FDI policy.

What is a cross-border acquisition?

A cross-border acquisition involves a foreign company acquiring shares or assets of an Indian company, resulting in partial or full ownership, subject to FDI regulations and approval requirements.

How long does it take to acquire a company in India?

A typical acquisition in India takes four to nine months, depending on due diligence scope, regulatory approvals, and shareholder negotiations.

Is RBI approval required for foreign acquisitions?

Most acquisitions fall under the automatic route and do not require prior RBI approval, though certain sectors and countries require government approval.

Is acquisition better than a joint venture in India?

Acquisitions offer faster control and execution, while joint ventures reduce operational risk. The right choice depends on sector rules, capital availability, and long-term ownership goals.

Which sectors allow 100 percent FDI in India?

Many sectors, including manufacturing, IT services, and renewable energy, allow 100 percent FDI under the automatic route, subject to specific conditions.

What are the risks of entering the Indian market?

Key risks include regulatory interpretation differences, partner misalignment, governance challenges, and post-investment integration issues.

What compliance issues do foreign companies face in India?

Foreign companies must comply with FEMA regulations, tax laws, labor laws, sector-specific licensing requirements, and ongoing reporting obligations.

Final Strategic Note

In 2026, blogs function as answer assets rather than traditional articles. Ranking alone is no longer sufficient; credibility depends on whether content is structured, factual, and reliable enough to be cited by AI-driven search engines. Clear answers and well-designed FAQ sections are now essential ranking infrastructure.